Get a $26k check per employee from the IRS

Your business was hurt. But you kept your employees on payroll. The Employee Retention Credit means the IRS might owe you up to $26,000 per employee. It is not a loan and does not need to be repaid.

No new submissions are being accepted at this time, but we are here to assist you with your ERC claim already made with us.

We’ve helped thousands of businesses earn back millions of dollars.

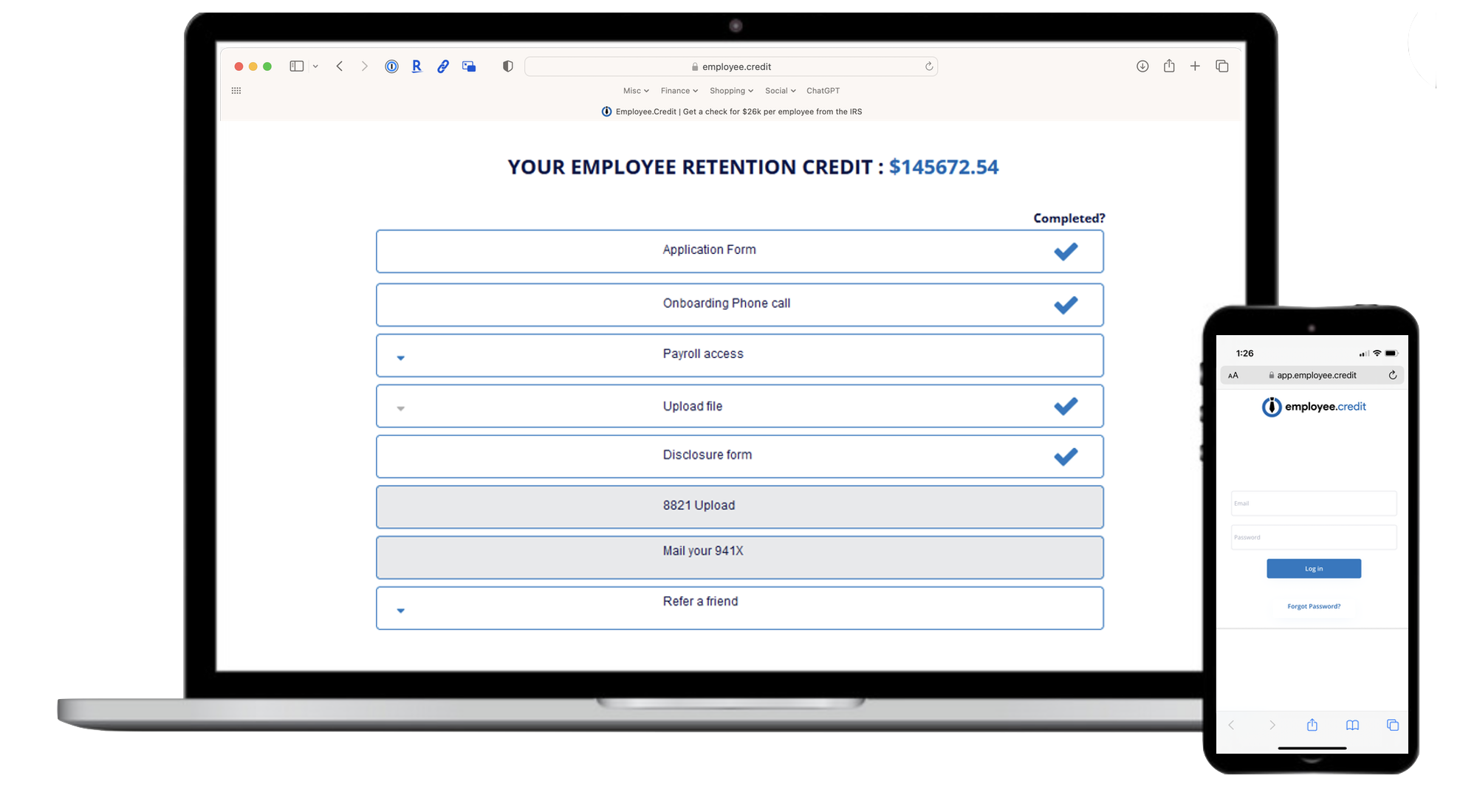

NEW: Dashboard App

Our ERC dashboard app will maximize your refund, and allow you to easily track the whole process.

No risk. No worries.

No charge if your business is not eligible.

About 50% of eligible businesses are not even aware of this government program. Luckily, that’s why we’re here.

“Within just three days Employee.Credit deemed us eligible for a huge credit and assisted us through the process.” - David U.

“Within just three days Employee.Credit deemed us eligible for a huge credit and assisted us through the process.” - David U.

“An absolute pleasure to work with. Top professionals, got our company huge credits with a quick turn around. Amazing customer support, highly recommended!” - Benjamin W.

“An absolute pleasure to work with. Top professionals, got our company huge credits with a quick turn around. Amazing customer support, highly recommended!” - Benjamin W.

“Amazing customer service, and they really own up to their word and make sure to get the money for the client like they say they would.” - Shlomo G.

“Amazing customer service, and they really own up to their word and make sure to get the money for the client like they say they would.” - Shlomo G.

“Extremely efficient and well-organized process. The team is comprised of experts on ERC. Their knowledge is second to none. The entire team operates with a constant sense of urgency that is evident in their quick response times. A true pleasure to deal with.” - David Klez

“Extremely efficient and well-organized process. The team is comprised of experts on ERC. Their knowledge is second to none. The entire team operates with a constant sense of urgency that is evident in their quick response times. A true pleasure to deal with.” - David Klez

“The Time to Apply for Employee Retention Credit is Now, Says Employee.Credit CEO”

AS FEATURED IN

Why thousands of companies choose Employee.Credit

Attorney Owned & Operated

You can rest easy knowing your business is in safe, secure, and experienced hands.

Best-In-Class Support

Just ask any of our clients. Our team treats every case with the urgency and responsiveness it deserves. This is your business, and we understand that!

Full Service & Scope

Our experienced accountants and lawyers ensure we fully maximize your credit in a way that few other firms can.

We have served thousands of companies just like yours…

We’re here to guide you through the process…

-

1. ESTIMATE

We evaluate your business to determine eligibility and then provide you with an estimated credit amount.

-

2. DOCUMENTS

Our experts puts together the most comprehensive documents package in the industry for filing with the IRS.

-

3. FILING

Your documents are filed with the IRS to receive your funds.

-

4. FUNDS

Once approved by the IRS, you receive your refund check.

FAQs

-

The Employee Retention Credit is a fully refundable tax credit for qualified wages (including allocable qualified health plan expenses) that Eligible Employers pay their employees.

-

Qualified health plan expenses are amounts paid or incurred by an Eligible Employer that are properly allocable to employees’ qualified wages to provide and maintain a group health plan, but only to the extent that these amounts are excluded from the employees’ gross income.

-

Yes, but not for the same wages. The amount of qualified wages for which an Eligible Employer may claim the Employee Retention Credit does not include the amount of qualified sick and family leave wages for which the employer receives tax credits under the FFCRA.

-

Eligible Employers for the purposes of the Employee Retention Credit are employers that carry on a trade or business during calendar year 2020, including tax-exempt organizations, that either: (1) Fully or partially suspend operation during any calendar quarter in 2020 due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to COVID-19; or (2) Experience a significant decline in gross receipts during the calendar quarter; or (3) began operations after February 14th 2020.

-

The credit is allowed against the employer’s share of social security taxes under section 3111(a) of the Internal Revenue Code (the “Code”), and the portion of taxes imposed on railroad employers under section 3221(a) of the Railroad Retirement Tax Act (RRTA) that corresponds to the social security taxes under section 3111(a) of the Code.

-

For 2020 the max is $5,000 per employee. For 2021, the maximum is $21,000 per employee.

-

The operation of a trade or business is partially suspended if an appropriate governmental authority imposes restrictions on the employer’s operations by limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to COVID-19 such that the employer can still continue some, but not all of its typical operations.

-

Yes, but not for the same wages. In other words, you cannot claim for the same period of time, both PPP forgiveness and ERTC.

-

Yes. Qualified wages are wages subject to withholding of federal income tax and both the employer’s and employee’s shares of social security and Medicare taxes. Qualified wages are also considered wages for purposes of other benefits that the employer provides, such as contributions to 401(k) plans.

Don’t disqualify yourself!

Just because your business received a PPP loan doesn’t mean you’re not eligible for ERC.

Watch More

Get In Touch

Any questions? Unsure of something? Want to clarify anything?

That is why we are here. Use the form at the top of the page to get started, or book a call with us using the button in the lower right corner.